.jpg)

Day 2 of Dbt Coalesce 2024 — Mastering AI with Data: How Salesforce and Fifth Third Bank are Pioneering Transformation with Dbt

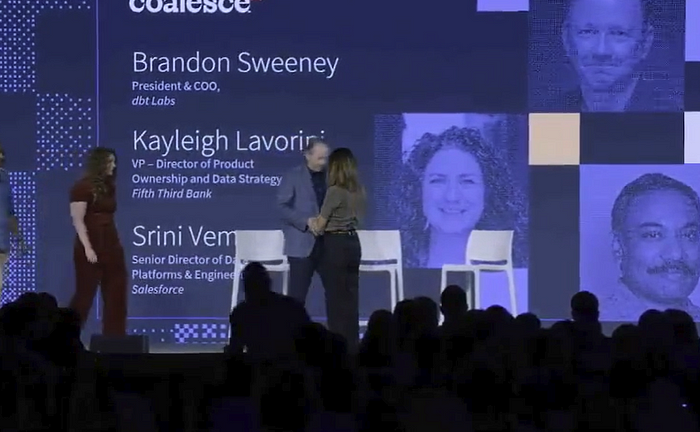

As Coalesce 2024 Day 2, Industry leaders from Fifth Third Bank and Salesforce took center stage to share their transformative journeys in data governance, AI adoption, and workflow optimization. The keynote session was actually a fireside chat that moderated by Brandon Sweeney, President and COO of Dbt Labs. It offered a deep dive into how companies are not only evolving their data practices but also aligning them with broader business goals. The discussion highlighted how dbt is playing a pivotal role in shaping their AI strategies, enabling scalable, efficient models that drive real business value.

The Shift to a Data-Driven Business Model: A New Era of Value Creation

Brandon Sweeney kicked off the session by discussing a critical business shift occurring across industries.

Data has evolved from a mere operational necessity into a key driver of business outcomes.

Companies are increasingly realizing that to fully leverage the potential of AI and machine learning, their data strategies must be closely aligned with their business objectives. Sweeney that explained that dbt is playing a transformational* role on helping companies like Salesforce and Fifth Third Bank. He stated that dbt is not just a tool for data management but a strategic asset in aligning data workflows with corporate goals.

*Pun intended

Fifth Third Bank: Strengthening Data Governance and Reducing Risk

Kayleigh Lavorini, Vice President and Director of Product Ownership and Data Strategy at Fifth Third Bank, provided valuable insights into how the financial institution approaches data governance and risk. For a bank operating in a highly regulated environment, managing data is not just about increasing efficiency; it’s about ensuring compliance and mitigating risk.

“All we care about from a data perspective is managing risk and governance,” Lavorini stated.

She explained that Fifth Third’s primary focus is on building robust, observable, and highly consumable data products that form the foundation for future AI and machine learning efforts. Recent announcements from Dbt Labs, particularly around data control planes, are aligned with the Fifth Third’s long-term vision of developing stronger governance frameworks. These control planes enable them to mitigate risks such as data redundancy and inaccurate metrics, which are critical concerns in the financial sector.

Lavorini also spoke about the importance of creating a flexible and scalable data architecture that can support both current operations and future innovation. For Fifth Third Bank, data governance is a cornerstone of their strategy as they move toward the adoption of advanced analytics and AI technologies. She emphasized that the tools provided by dbt enable more stringent data governance, giving the bank the confidence to explore new technologies like AI without compromising on compliance or increasing operational risk.

Salesforce: Leveraging DBT for AI-Driven Outcomes

Srini Vemuru, Senior Director of Data Platforms and Engineering at Salesforce, offered a contrasting but complementary perspective. I key point to keep in mind is that Salesforce is a tech company with a very different business model from Fifth Third Bank. But the role of data in driving AI initiatives is similar at the foundation level. At Salesforce, dbt is integral to the creation of AI-ready data sets that feed into sophisticated machine learning models.

“Our feature store is built using dbt, powering attribution models and scoring models within Salesforce’s B2B business,” Vuru explained.

He discussed how dbt helps define, structure, and maintain the datasets that fuel Salesforce’s AI and machine learning teams, enabling them to build models that impact core business functions like sales and marketing.

Vemuru’s team is particularly excited about the newly announced dbt Co-Pilot*. As Salesforce continues to scale its AI efforts, the ability to streamline workflows and eliminate duplication is becoming increasingly important. Vemuru highlighted how dbt Co-Pilot will be a game-changer for his team, allowing them to focus on driving business outcomes instead of managing redundant processes.

* Co-Pilot is designed to identify inefficiencies in data workflows, such as model redundancy and duplication.

A Shared Vision: Foundational Data for AI Success

Despite the differences between the banking and tech industries, both Lavorini and Vemuru agreed on one crucial point:

Strong, well-governed data is the foundation upon which successful AI models are built.

At Salesforce, this manifests in scalable data models that support AI-driven decisions across marketing and sales functions. At Fifth Third Bank, data is used to manage risk, ensure compliance, and lay the groundwork for future AI and machine learning initiatives.

Both speakers underscored that while AI holds the potential to revolutionize decision-making and efficiency, it’s only as powerful as the data that supports it. For both organizations, AI is not just a technological add-on -it’s a tool for solving real business problems. When integrated with a well-architected data strategy, AI can reduce inefficiencies, enhance decision-making, and ultimately create measurable business value.

The Future of DBT and AI: What’s Next?

As the fireside chat drew to a close, it became clear that the future of dbt and AI is bright. Companies across sectors are looking for ways to scale their data operations while maintaining strict governance, eliminating redundancies, and unlocking the potential of AI to drive business growth. Both Lavorini and Vemuru agreed that dbt will play a central role in this journey.

Vemuru pointed out that the integration of dbt with other platforms, like Tableau, adds yet another layer of innovation. This integration enables advanced reporting, dashboarding, and data visualization, which will be critical as companies continue to rely on data to inform strategic decisions.

In the financial sector, Lavorini remains focused on governance and risk management, but she also hinted at the exciting possibilities that lie ahead. Fifth Third Bank is preparing for the future adoption of AI and machine learning technologies to automate key processes, enhance decision-making, and improve overall efficiency. The bank’s use of dbt to build a “next-generation analytical tech stack” positions it well for this future, providing a solid foundation for further AI-driven innovation.

Conclusion: DBT’s Role in Shaping the Future of AI

The fireside chat highlighted the critical role that dbt plays in helping companies like Salesforce and Fifth Third Bank chart a course for AI success. By aligning data workflows with business outcomes, these organizations are well on their way to building scalable, efficient AI models that create measurable value.

For Salesforce, dbt is enabling the development of impactful AI models that drive performance in their B2B business. For Fifth Third Bank, it’s a tool that supports risk management and governance, while also laying the foundation for future AI adoption. In both cases, the ability to manage, govern, and optimize data workflows is proving to be a significant competitive advantage.

As these companies continue to integrate dbt’s powerful tools into their operations, they are not just enhancing their own data strategies, they are shaping the future of AI in business. With the ongoing evolution of dbt and AI, the next few years promise to bring even greater innovation, efficiency, and business impact.

You can read about Day 1 on Medium here.